03

Seminar

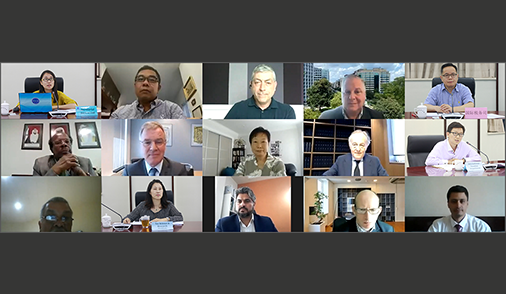

The virtual Seminar on Tax-related Data Governance and Application was held on April 8, 2021 with participants from BRITACʘM Council Member Tax Administrations, Observers, Advisory Board, and representatives from business in attendance.

02

Seminar

The virtual Seminar on Service and Administration for Value Added Tax (VAT) in Digital Time was held on 15 October 2020 with participants from BRITACʘM Council Member Tax Administrations, Observers, Advisory Board, and representatives from business in attendance.

Service and Administration for VAT in Digital Times

> Online invoicing and online cash

registers by Hungary

> Immediate Supply of Information on

VAT(SII system)

> Making Tax Digital for VAT

> E-Tax Invoice System Introduction

Follow-up Meeting

> Digital tax administration:Impact on

indirect tax

> VAT Considerations in the Digital

Economy and Cross Border

Transactions

> Q & A for the Speakers of Seminar 2

> Experience Sharing by Participants: Service and Management of VAT under Digitalization Condition-Experience from China

Follow-up Meeting

01

Seminar

The virtual Seminar on Business Continuity in Response to COVID-19 was held on 30 July 2020. Representatives from BRITACʘM Council Member Tax Administrations, Observers, and Advisory Board, and officials from the World Bank Group and the OECD attended this Seminar.

Business Continuity in Response to COVID-19

>

Impact of COVID-19 on the

global

economy

> Response to COVID-19

Digitalization of Tax Services

>

Singapore’s Smart Nation

initiative

>

Digitalization of Tax Services

from

STA

> Executive Leadership Program on Tax and Digital Transformation

Digitalization of Tax Services

Copyright @ 2020 BRITACʘM. ALL RIGHTS RESERVED