06 Part Six Future Prospects

updated:2025-09-04 China

Amid evolving global economic conditions and rapid technological advancements, the taxpayer service system is undergoing profound transformation. Future taxpayer services will focus more on brand building, enhancing cross-departmental coordination and international cooperation, widely adopting digital and intelligent technologies, and implementing green, efficient service models. These efforts are aimed at fostering a more equitable, transparent, and efficient tax environment to meet the high-standard demands of modern society. This section will conduct an in-depth exploration of the aforementioned key areas and provide comprehensive conceptual research reports to assist tax authorities in enhancing service quality, addressing the increasing service demands of taxpayers, and further advancing the modernization of the tax governance system and capabilities.

To meet the demands of the new era characterized by globalization and the rapid advancement of information technology, promoting the development of brand building for taxpayer services has become a crucial initiative to improve tax management effectiveness and taxpayer service quality. In the context of global economic integration, it is difficult for the traditional taxpayer service model to meet modern taxpayers' demand for efficient and convenient services, which makes brand building especially crucial. By establishing high-quality taxpayer service brands, not only can the social credibility and public image of tax authorities be enhanced, but taxpayer satisfaction and compliance can also be significantly improved. The benefits of brand building are as follows: first, it helps establish a fair and transparent tax environment and promote social trust; second, it optimizes resource allocation and improves service efficiency and quality; third, it stimulates internal management innovation and helps develop a taxpayer-centric service culture. These collective efforts aim to foster a more harmonious and efficient relationship between taxpayers and tax authorities, and advance tax authorities toward high-quality development.

So, how will we optimize the service system, enhance communication mechanisms, expand brand promotion, and develop professional talent in the future? We will launch the Micro Report (No.1): Brand Building for Taxpayer Services (to be released in 2029).

To address the new challenges posed by the rapid advancement of information technology and changes in the global economic landscape, advancing the digitalization and intelligence of taxpayer services has become a crucial initiative for improving tax management efficiency and service quality. This initiative not only addresses the increasing demand of taxpayers for convenient and efficient services but also serves as a crucial method to streamline tax administration processes and enhance data processing capabilities. Digitized and intelligent taxpayer services offer several advantages: first, they significantly enhance tax processing efficiency by reducing manual operation time and error rates through automated processing and intelligent analysis; second, they improve the personalization and accuracy of services, and offer tailored solutions based on taxpayers' specific circumstances; third, they foster tax transparency and fairness, and ensure that the implementation of tax policies is just and effective. In addition, with the aid of advanced technologies such as big data and cloud computing, tax authorities can more effectively anticipate and respond to market changes, support economic decision-making, and promote the healthy development of the economy and society.

So, what innovative applications will artificial intelligence have in taxpayer services in the future? We will launch the Micro Report (No.2): Implementing Artificial Intelligence in Taxpayer Services (to be released in 2029).

With the growing complexity of economic activities and the diversification of taxpayers' needs, implementing targeted taxpayer services has become a crucial choice for enhancing tax management efficiency and service quality. Targeted taxpayer services aim to precisely identify the individual needs of various taxpayers and offer customized taxpayer service solutions, thereby enhancing tax compliance and satisfaction. Its advantages are primarily reflected in three aspects: first, enhancing service targeting to ensure that all types of taxpayers receive support tailored to their specific needs; second, optimizing resource allocation through the refinement and optimization of service processes to maximize resource utilization efficiency; third, improving service quality, as meticulous services can effectively address the practical challenges faced by taxpayers and foster a positive tax-enterprise relationship. Implementing targeted taxpayer services not only contributes to building a harmonious tax environment but also provides a solid foundation for the modernization of tax operations.

So, how will the future taxpayer service system evolve in a more refined direction? We will launch the Micro Report (No.3): Targeted Taxpayer Services (to be released in 2029).

Amidst the evolving global economic landscape and the growing emphasis on sustainable development, implementing sustainable and efficient taxpayer services is not only a crucial aspect of taxpayer service management innovation but also a tangible step in aligning with the national (regional) green development strategy. The aim of sustainable and efficient taxpayer services is to reduce energy consumption and environmental pollution while enhancing service efficiency through process optimization, minimizing paper usage, and promoting electronic service methods. The advantages are primarily reflected in the following aspects: first, significantly reducing resource waste by achieving paperless operations through digital transformation, which is environmentally-friendly and enhances data processing speed; second, improving service convenience and enabling taxpayers to access 24/7 online services, thereby greatly reducing tax processing time; third, enhancing the efficiency and service quality of tax authorities which contributes to the creation of a fair and transparent tax environment. Implementing sustainable and efficient taxpayer service strategies not only facilitates the achievement of energy-saving and emission-reduction goals but also contributes to the sustainable development of the economy and society.

So, how will taxpayer services become more environmental-friendly and efficient? We will launch the Micro Report (No.4): Sustainable and Efficient Taxpayer Services (to be released in 2029).

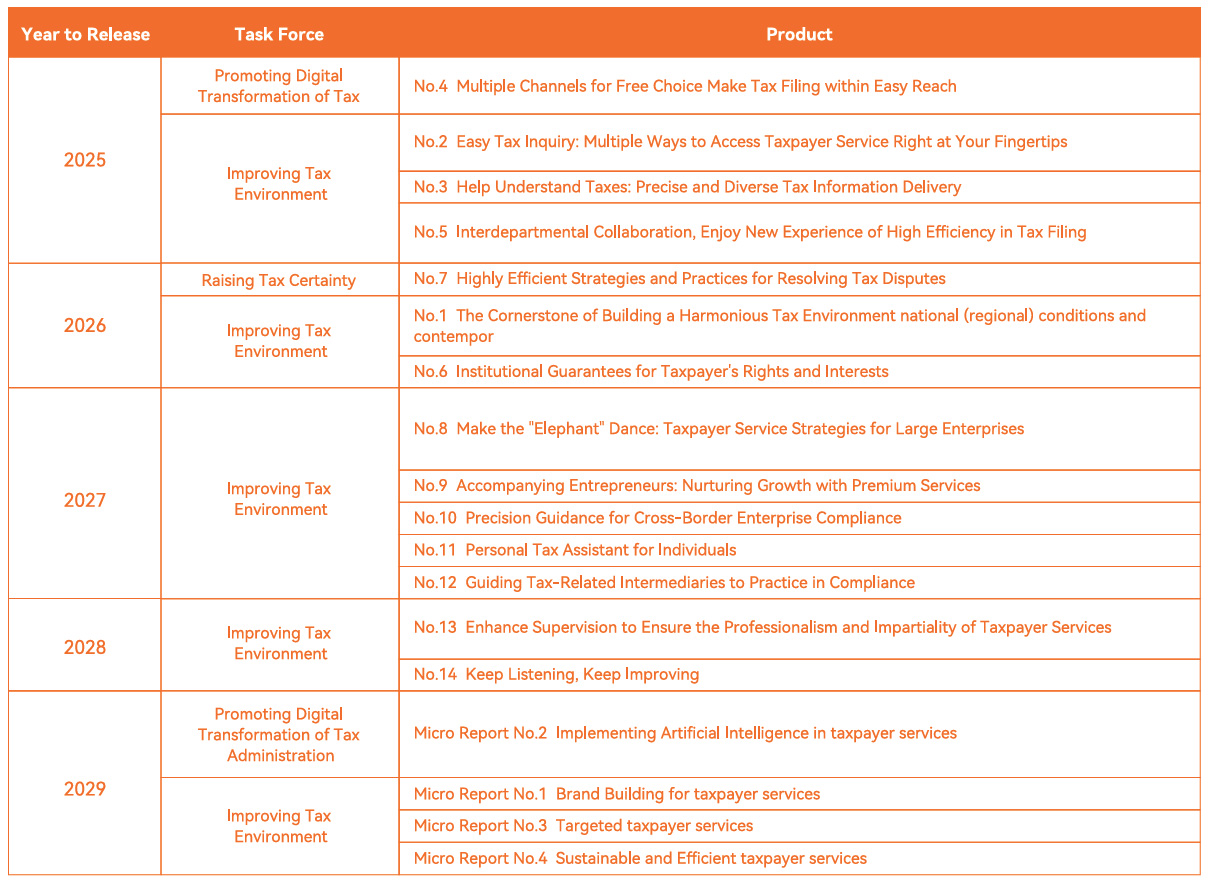

Taxpayer Service Product Portfolio with the Hong Kong Action Plan Task Force (2025-2027)

Copyright @ 2020 BRITACOM. ALL RIGHTS RESERVED