03 Part Three Basic Taxpayer Services

updated:2025-09-03 China

With the aim to promote tax compliance, tax authorities offer universal services to all taxpayers, which is a vital part of the taxpayer service system. By enhancing basic taxpayer services, it is possible to achieve multidimensional improvements in tax efficiency, governance effectiveness, and sustainable development. This section introduces the extensive support and services provided by tax authorities in three key areas: Build Compliance Together, Enhancing Accessibility of Services, and Safeguard Rights and Interests. It covers assistance for taxpayers in compliantly benefiting from policies, efficiently handling tax matters, and protecting legitimate rights, while also introducing 6 corresponding Taxpayer Service Products.

Operating in compliance with laws and regulations is not only a fundamental requirement for businesses to establish themselves in the market but also the essential guarantee for achieving long-term development. Tax compliance is a core proposition in establishing a modern tax governance system for tax authorities, involving multiple dimensions such as institutional design, technological application, behavioral guidance, and multilateral cooperation. Currently, the increasing diversity of market entities and the emergence of new economic models and business formats have heightened the challenges of tax supervision. From the perspective of taxpayer service, it is essential to improve the transparency of tax policies by offering tax-related enquiries and publicity and guidance, reduce the costs for taxpayers in accessing information and completing procedures, assess the risks and consequences of tax non-compliance, further reinforce the value of tax compliance and risk management, and thereby enhance tax law adherence and ensure revenue collection. This section will elaborate on tax-related enquiries and publicity and guidance, introducing two corresponding Taxpayer Service Products.

Modern tax systems involve the coordination of multiple taxes such as income tax, turnover tax, and property tax, compounded by the emergence of new business models like the digital economy and cross-border trade. This makes it essential for tax authorities to provide efficient, professional, convenient, and free advisory services. By establishing diversified and intelligent enquiry platforms that provide professional, timely, and standardized responses, tax authorities can help taxpayers quickly understand tax policies, efficiently resolve tax-related issues, legally benefit from tax support policies, reasonably reduce tax burdens, and thereby enhance mutual understanding and trust. Scholars argue that there is a strong positive correlation between enhancing tax certainty and promoting tax compliance, and that providing high-quality tax-related enquiry services is one of the key measures to improve tax certainty.

The tax-related enquiry services provided by tax authorities are of great significance to taxpayers. First, it helps them operate compliantly. Enterprises must comply with national tax laws and regulations to ensure lawful business operations and production activities. Tax-related enquiry services can provide accurate interpretations of tax policies and legal compliance guidance, helping businesses understand applicable tax regulations and avoid violations of tax laws. Second, it helps them reduce tax compliance costs and enhance economic benefits. Tax authorities provide professional and timely tax-related enquiry services to businesses, such as answering questions about policy applicability, tax filing, and tax inspections. This eliminates the need for businesses to search for or study related content through other channels, enabling them to handle tax-related matters efficiently, accurately, and promptly, fulfill their tax obligations, and reduce both time and financial costs. Third, it helps them reduce tax dispute risks. Tax disputes are common issues faced by businesses, and differing interpretations of policies between tax authorities and companies are a major cause of such disputes. The enquiry services provided by tax authorities can help eliminate ambiguities and ensure accurate understanding, reducing information asymmetry between tax authorities and taxpayers, and assisting enterprises in preventing and resolving potential tax disputes.

So, how can efficient, authoritative, and convenient tax-related enquiry services be provided to taxpayers? We have launched the Taxpayer Service Product No.2: Easy Tax Enquiry: Multiple Ways to Access Taxpayer Service Right at Your Fingertips (September 2025).

In the current context of increasingly detailed tax policies, some enterprises lack the capability to interpret policies accurately. This may result in either failing to benefit from preferential policies or improperly claiming policies they do not qualify for, leading to compliance risks. Tax authorities' publicity and guidance initiatives aim to address tax-related demands lawfully and efficiently. They involve scientifically categorizing target groups, coordinating the development of tax education materials, selecting appropriate dissemination channels and guidance methods, tracking effectiveness, and leveraging both tax authorities' resources and external support such as tax-related professional services. By adopting a systematic approach, tax authorities design and implement concrete, feasible, and effective compliance-focused publicity and guidance strategies. These efforts guide taxpayers to fulfill their tax obligations in good faith, promote lawful and efficient tax collection by authorities, enhance societal awareness of tax compliance, and foster a culture of lawfulness, integrity, and a rule-of-law tax environment. At the same time, the principle of transparency is a fundamental principle of the WTO. According to this principle, WTO member countries (regions) must publish their current trade policies, regulations, tax laws, and other relevant information. This requirement underscores the necessity of tax publicity and guidance.

The development of the economy and society depends on a favorable tax environment and efficient taxpayer services. The publicity and guidance provided by tax authorities help taxpayers fully understand and utilize tax policies, enabling efficient and sustainable development. First, improve tax awareness and compliance. Taxpayers need to clearly understand their tax obligations and adjust their tax behavior from the perspectives of tax risk and compliance. Tax publicity and guidance can help popularize tax law knowledge, enhancing taxpayers' awareness and understanding of tax laws and regulations. By utilizing new media platforms such as short videos and live streams to share typical cases of tax violations, it raises public awareness of the risks and costs associated with tax non-compliance. This fosters a stronger sense of tax risk prevention, reduces violations, and helps maintain a sound tax order. Second, optimize the tax business environment. Tax authorities offer personalized tax publicity and guidance services through various channels and methods, effectively assisting taxpayers in addressing challenges and difficulties during tax-related processes, thereby enhancing efficiency and service quality. This helps create a fair, transparent, and predictable tax environment, enhancing the taxpayers' sense of gain. Third, support enterprises in achieving steady and sustainable growth. Through tax publicity and guidance, taxpayers can gain a better understanding of national macroeconomic policies and tax incentives. This enables them to develop sound business plans, legally minimize tax liabilities, and enhance economic performance in accordance with tax policy directions and their specific circumstances.

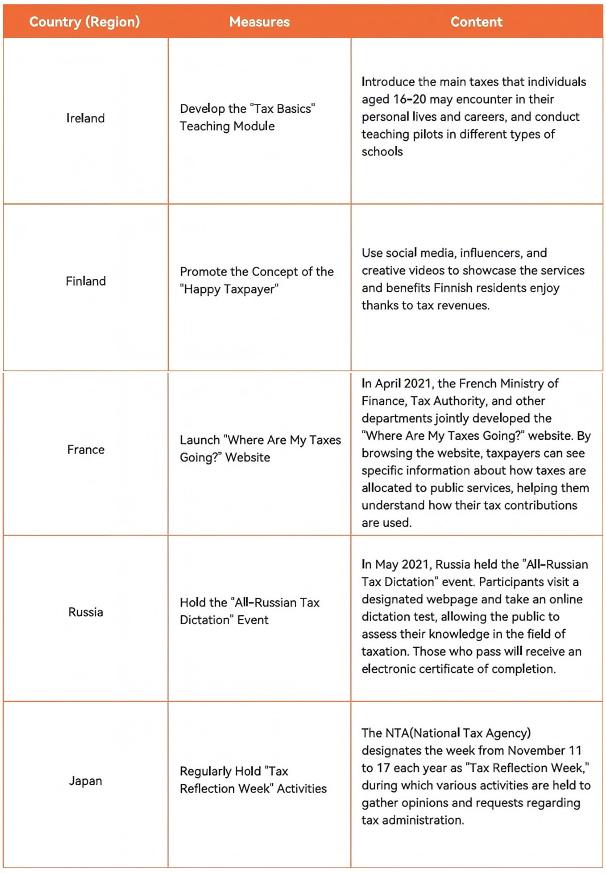

Table 1: Tax Publicity and Guidance Initiatives in Selected Countries(Regions)

Thus, how can we effectively carry out tax promotion and provide enquiry services, and maximize their benefits? We have launched the Taxpayer Service Product No.3: Help Understand Taxes: Precise and Diverse Tax Information Delivery (September 2025) .

Amid the global trend of digital transformation and inclusive development in tax governance, improving taxpayer service convenience has become a key pathway to enhancing administrative efficiency and strengthening taxpayer confidence. In response to taxpayers' urgent demand for efficient and transparent government services, tax authorities have begun prioritizing "user experience" to redesign service approaches, breaking down information barriers and operational silos through process reengineering and collaborative governance. Tax authorities must urgently establish a multi-tiered, responsive service system through upgrades to physical service networks, digital platform innovation, and cross-departmental collaborative governance. First, they should enhance in-person taxpayer services by standardizing processes, providing multilingual support, and implementing accessibility features to address personalized complex matters, resolve tax disputes, and offer professional face-to-face guidance for special-needs groups. Second, they should build an online digital service ecosystem, utilizing smart form pre-filling, real-time data validation, and automated approval functions to facilitate more online transactions and concurrent guidance. Third, they should strengthen inter-agency collaboration mechanisms by implementing unified data exchange standards, joint risk alert systems, and multi-department parallel approval channels to eliminate redundant submissions and information fragmentation. This section outlines how to enhance taxpayer service convenience by offering both online and offline taxpayer services and fostering collaboration within and across departments, and will introduce two corresponding Taxpayer Service Products.

Global tax governance is undergoing a critical transition from physical services to a digital ecosystem. With updates to digital service taxation rules and the evolving differences in multi-jurisdictional compliance requirements, the complexity of policy interpretation, filing procedures, and dispute resolution continues to increase.

The integrated online-offline service model deeply combines physical services for handling tax business locations with electronic tax filing services methods. Through efficient coordination of data flows and service chains, it delivers smoother and more convenient service experiences, achieving seamless restructuring of the service ecosystem. This model is not limited to simple channel integration but encompasses all aspects of taxpayer service system operations, including but not limited to system support, process optimization, and role allocation. This model transcends time and space constraints, offering taxpayers diverse taxpayer service options while significantly enhancing service accessibility and convenience. By leveraging real-time data sharing and seamless process integration, it improves overall taxpayer service efficiency and effectively reduces the costs of both tax authorities and taxpayers.

Online E-Tax China: Technology-Driven Efficiency Enhancement

The E-Tax China provides an online taxpayer service channel for taxpayers. Guided by tax laws, regulations, and normative documents, and based on the latest operational requirements, it integrates related business scenarios by leveraging the interconnected nature of certain functions, achieving the goal of fully online tax-related services. As an efficiency-driven technological platform, the E-Tax China system significantly enhances the effectiveness of taxpayer service through process integration, data interoperability, and intelligent applications. First, it streamlines processes and simplifies operations. By integrating filing, payment, and information update functions, it enables "one-click processing" for high-frequency tax-related services. Second, it enables intelligent risk control and precise guidance. Leveraging information technology to instantly compile corporate tax information, it monitors risks in real time, flags anomalies, and delivers tailored policy updates based on business needs. Third, it promotes ecosystem collaboration and cross-regional connectivity. Through information integration and data collaboration, it enables multi-departmental information exchange. It also establishes cross-regional online processing channels, breaking down regional barriers and enhancing service efficiency.

In-Person Taxpayer Service Hall: A Professional Support Hub

Physical taxpayer service halls are venues where tax authorities provide centralized services for handling tax business, maintaining their irreplaceable value in the digital era. First, bridge the digital divide to ensure service accessibility. For vulnerable groups unfamiliar with digital technology, facing access barriers or preferring face-to-face interaction (e.g. , elderly individuals and some small businesses) , physical service centers serve as the cornerstone for ensuring their equitable access to taxpayer services. Taxpayer service halls effectively address taxpayers' "last-mile" services for handling tax business challenges by offering multilingual services and on-site staff guidance for electronic system operations. Second, establish a physical platform for building trust and resolving disputes. Face-to-face communication offers unique advantages in building mutual trust between tax authorities and taxpayers, providing detailed policy explanations, and promptly resolving potential disputes. Physical service halls provide taxpayers with direct channels to express concerns, seek assistance, and file appeals, serving as key platforms for transparency and fairness while enhancing voluntary compliance and satisfaction.

To provide taxpayers with a new, convenient taxpayer service experience that integrates online and offline services, we have launched Taxpayer Service Product No.4: Integration and Interconnection: Creating a New Model for Convenient Taxpayer Services Online and Offline (September 2025) .

Amid the regional economic collaboration, accelerated digital transformation, and ongoing tax policy reforms, the scope of tax-related services continues to expand with significantly increasing complexity. Interdepartmental collaboration has become a key measure for reducing taxpayers' compliance costs and enhancing service efficiency. By strengthening in-depth collaboration within tax authorities and between tax and other relevant departments, we can streamline processes, dismantle information silos, and eliminate taxpayers' need to shuttle between multiple agencies and submit duplicate documents, significantly reducing service cycle times.

Internal collaboration within tax authorities facilitates the sharing of tax-related information and coordinated processing, improving the efficiency and effectiveness of taxpayer services. A seamless interdepartmental information network ensures real-time, accurate transmission of declaration data, policy interpretations, and taxpayer feedback, equipping all staff with the latest and most comprehensive information to support efficient service delivery. Collaboration between tax authorities and external departments facilitates the development of a comprehensive and integrated service ecosystem. Based on shared service objectives, all parties have established a robust information exchange platform, enabling real-time data sharing and seamless business collaboration. When handling various tax-related matters, departmental barriers are eliminated, processes are streamlined, and redundant work is reduced, providing taxpayers with convenient one-stop services. Through such cross-departmental collaboration, resources from all parties can be effectively integrated, leveraging the professional expertise of each department to enhance the professionalism and precision of taxpayer service. This approach effectively addresses various challenges taxpayers face during tax processes and improves overall service efficiency.

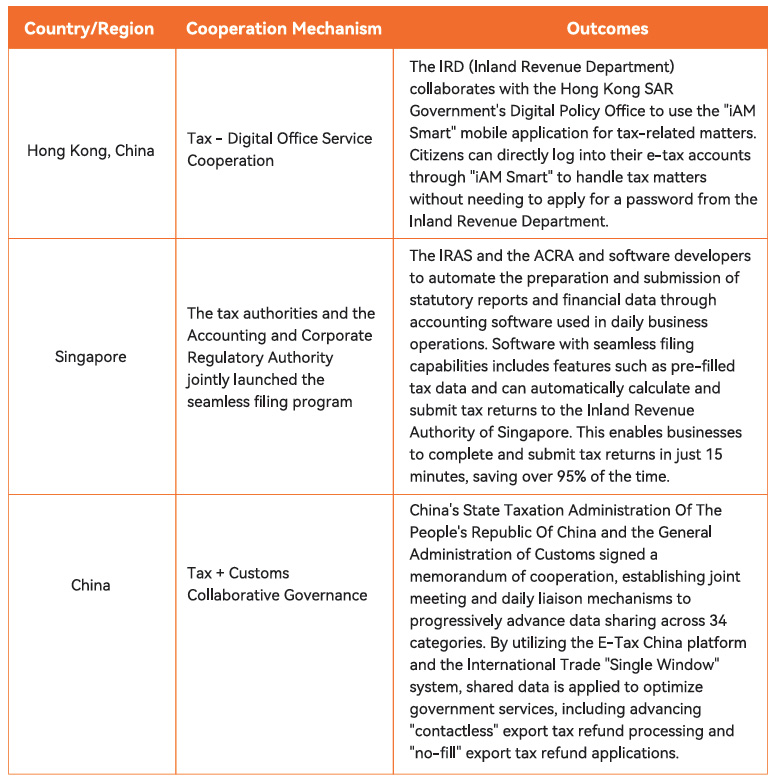

Table 2:Interdepartmental Collaboration Initiatives and Outcomes in Selected Countries/Regions

Interdepartmental collaboration has transformed taxpayer services from fragmented to coordinated, not only providing efficient, convenient and new experiences for taxpayers but also significantly enhancing the overall integrity and fairness of tax governance. Taxpayer service is no longer fragmented but has formed an integrated system. The departments fulfill their responsibilities and collaborate with each other to provide taxpayers with comprehensive and high-quality services.

To showcase how interdepartmental collaboration delivers a new and highly efficient tax processing experience, we have launched the Taxpayer Service Product No.5: Interdepartmental Collaboration, Enjoy New Experience of High Efficiency in Tax Filing (September 2025) .

With the ongoing development of international cooperation, legal safeguards, and technological applications, the growing number of cross-border taxpayers has brought data security and privacy issues to the forefront of taxpayers' rights and interests protection concerns. International organizations, governments, and the global community are taking various measures to promote continuous progress in safeguarding taxpayers'rights and interests. Meanwhile, OECD research indicates that if tax authorities overly prioritize tax revenue while neglecting taxpayers' rights and interests, it may erode public confidence in their ability to perform duties properly. A loss of confidence in tax enforcement could reduce compliance with tax laws. Therefore, it is particularly urgent to ensure that taxpayers' legitimate rights and interests are fully protected while fulfilling their tax obligations.

Protecting taxpayers' legitimate rights and interests is not only crucial for tax administration, but also an essential component of modern social governance. This not only improves taxpayers' satisfaction and compliance, but also serves as a key measure to uphold social fairness and justice, foster harmonious relations between taxpayers and tax authorities, advance the tax rule of law in taxation, and optimize the tax business environment. By establishing robust rights protection mechanisms, enhancing awareness and education on taxpayers' rights, providing effective channels for complaint and dispute resolution, and ensuring fairness and transparency in tax policy implementation, we can enhance public trust in tax authorities and lay a solid foundation for building a healthier and more orderly tax environment. This section will elaborate on two aspects: the establishment of rights protection systems and the efficient resolution of tax disputes, and introduce two corresponding Taxpayer Service Products.

The protection of taxpayers' rights constitutes both recognition and safeguarding of fundamental civil rights. Decisions made by tax authorities are more likely to be accepted when they are perceived as protecting taxpayers' interests. Tax authorities should formalize the specific rights of taxpayers in institutional terms to provide guidance when taxpayers assert their rights. Similarly, tax authorities should establish ethical standards and codes of conduct for their staff and ensure the confidentiality of taxpayers' information. Any unauthorized disclosure of protected information, infringement upon taxpayers' rights, or violation of established conduct protocols shall be subject to appropriate legal proceedings or disciplinary measures. By enacting relevant laws, regulations, and institutional frameworks for clarifying taxpayers' rights and obligations and standardizing enforcement actions of tax authorities, the abuse of power can be effectively prevented. This ensures that tax authorities operate within the rule of law and enhances the legal framework of tax governance.

The institutional development of protection of taxpayers' rights and interests is a vital component of tax governance. Tax authorities should have strong capabilities to strike an appropriate balance between taxpayers' legitimate rights and the enforcement powers of tax authorities. The institutionalization of protection of taxpayers' rights and interests can provide a stable and predictable tax environment for taxpayers and stimulate the vitality and creativity of market entities. When taxpayers' rights and interests are effectively protected, their sense of identification and trust towards tax laws increases, thereby enhancing their voluntary compliance with tax regulations. Institutional development can be standardized across multiple dimensions, which includes promoting tax transparency to protect taxpayers' right to be informed, advancing law-based administration and standardizing law-enforcement practices, improving the communication mechanism between tax authorities and taxpayers to foster a harmonious relationship, further establishing a tax risk prevention mechanism to encourage compliance, promoting efficiency and reducing burdens, and lowering taxpayers' compliance costs. Simultaneously, it is essential to enhance the confidentiality of tax-related information and safeguard taxpayers' right to privacy.

So, how can we effectively protect taxpayers' rights and interests from the perspective of legal and regulatory system construction? We will launch the Taxpayer Service Product No.6: Institutional Guarantees for Taxpayer's Rights and Interests (to be released in 2026).

As the cornerstone of the tax administration system, the core purpose of taxpayer service is to effectively safeguard the legitimate rights and interests of taxpayers. When disagreements arise between tax authorities and taxpayers regarding tax-related matters, tax disputes may occur. In recent years, with the deepening of economic globalization and increasing complexity of business activities, tax laws and regulations have shown both hysteresis and regional disparities. Meanwhile, intensified tax supervision, deeper application of information technology, and heightened taxpayers' awareness of rights have collectively driven a significant increase in tax-related disputes worldwide. In this context, the efficient resolution of tax disputes is of critical practical significance and strategic value for maintaining the rule-of-law order in taxation, ensuring stable national (regional) fiscal revenue, fostering a fair and competitive market environment, and effectively safeguarding taxpayers' legitimate rights and interests.

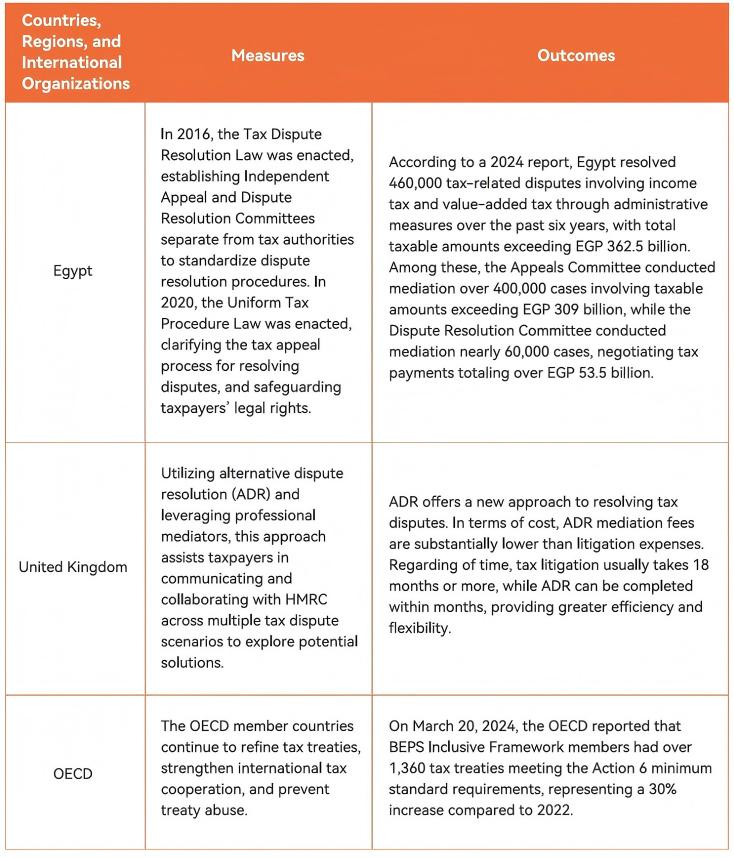

According to the World Bank Group's latest Business Ready (B-READY) assessment framework, tax dispute resolution mechanisms have been incorporated as a critical dimension for evaluating the tax business environment and integrated into the "Dispute Resolution" indicator system. Efficient resolution of tax disputes is pivotal to protecting the rights of both tax authorities and taxpayers, maintaining tax order, and improving tax compliance. Therefore, tax authorities employ a comprehensive approach that includes mediation, reconsideration, and litigation, integrating diverse resources to establish professional mediation teams and standardized procedures. Upholding principles of fairness and impartiality, they promote the implementation of tax policies and prevent conflicts between tax authorities and taxpayers through legal frameworks and methods. This approach continuously optimizes dispute resolution processes and enhances the capacity to resolve disputes effectively. Some jurisdictions are exploring the use of precise legal interpretation and tiered mediation to reduce adversarial costs between tax authorities and taxpayers, enhancing tax compliance and promoting social fairness and justice (Table 3: Dispute Resolution Measures and Outcomes in Selected Countries, Regions, and International Organizations) . For example, Chinese tax authorities' approach to mediating tax disputes through the "Fengqiao" Experience involves establishing a dispute resolution mechanism of "prevention at the front end, mediation in the middle, and resolution at the back end, " resolving disputes at their early stages and addressing conflicts at the grassroots level. On one hand, it safeguards the legitimate rights and interests of taxpayers, stabilizes market expectations, and optimizes the business environment. On the other hand, it ensures national tax security, enabling the tax authorities to learn from dispute cases, thereby improving enforcement capabilities and refining tax administration processes.

Table 3: Dispute Resolution Measures and Outcomes in Selected Countries, Regions, and International Organizations

To efficiently resolve tax disputes, we will launch the Taxpayer Service Product No.7: Highly Efficient Strategies and Practices for Resolving Tax Disputes (to be released in 2026).

Copyright @ 2020 BRITACOM. ALL RIGHTS RESERVED