Carrying out tax-related training activities is an important part of the BRITACEG’s work as it plays its functional role and implements the capacity building tasks set out in the Nur-Sultan Action Plan (2022-2024). The BRITACEG has held its first training program in May 2019, which marked the beginning of tax authorities of the BRI jurisdictions jointly improving their tax administration capabilities. Due to the impact of COVID-19, from 2020, the BRITACEG training was held online through the BRITA website (https://www.brita.top/), equipped with functions of training registration, participation, exams, and evaluations. In 2023, the BRITACEG restarted offline training activities, well combined with online training under continuous improvement of website functions and enrichment of course content, providing more learning approaches and opportunities for tax officials of the BRI jurisdictions.

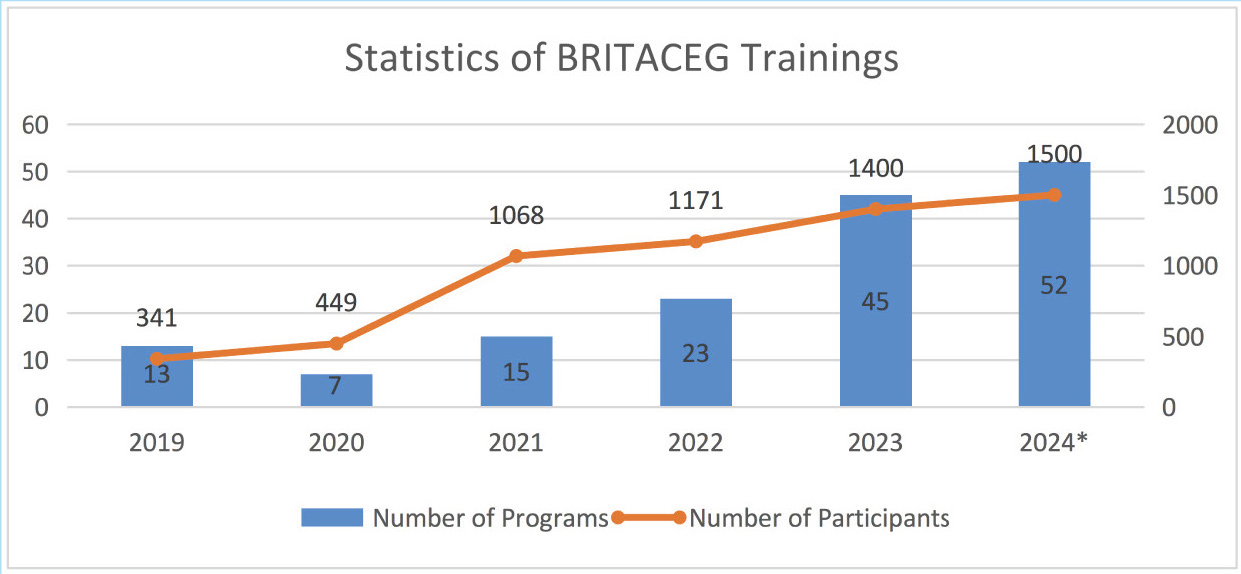

For these years, the BRITACEG has held over 140 face-to-face and virtual training events covering around 6000 tax officials from more than 120 jurisdictions participating, deepening tax cooperation and friendship among these jurisdictions. Especially since 2022, the influence of the BRITACEG training has been expanding in international taxation area. The BRITACEG is gradually establishing its training brand featuring professionalism and high-quality. During the implementation of the Nur-Sultan Action Plan (2022-2024), the BRITACEG carried out 120 training programs covering 4400 attendances of the BRI jurisdictions.

2024*: includes statistics for both currently completed and expected future programs

Training Characteristics

Rich themes and well directed. Based on the needs of tax authorities and trainees of the BRI jurisdictions, the BRITACEG focuses on the development requirements of international tax governance, and provides targeted training programs based on questionnaires. The BRITACEG training includes topics of“ value-added tax reform, tax administration, tax certainty, taxpayer service”, focusing on basic theory and operational guidance, as well as macro research topics such as“ theory and practice of tax policy and administration”, and“ current issues in tax law design”. It also combines practice sharing of typical cases of corresponding topics to meet the learning needs of different regions and positions.

Flexible form and in-depth experience. The BRITACEG training, especially offline training, offers various teaching forms, including inviting senior experts to give lectures, organizing seminars and discussions, innovatively carrying out on-site teaching activities, experiencing taxpayer service measures and digital tax administration system, visiting representative economic and cultural units such as museums and enterprises. Through the combination of theory and practice, as well as the integration of classroom teaching and onsite visiting, diversified teaching methods have not only improved the quality of courses, but also allowed participants from different jurisdictions to enhance mutual understanding and deepen awareness of common construction and development through learning and communication, enhance friendship and mutual trust, and promote cooperation and progress.

Cooperative education and wide-range influence. In addition to independent training, the BRITACEG also carries out training activities in joint and collaborative methods with the support and assistance from organizations such as the Organisation for Economic Cooperation and Development (OECD), the International Monetary Fund (IMF), and the China International Development Cooperation Agency (CIDCA), achieving resource sharing. Themed training courses such as“ Tax Treaties and Multilateral Conventions” jointly organized by OECD in BRITA · Yangzhou have provided more opportunities to participate for the BRI jurisdictions. The BRITACEG has co-hosted 26 training programs with the CIDCA for consecutive years, as well as 8 joint training programs with China-IMF Capacity Development Center (CICDC) under the IMF. The CIDCA and CICDC provide support in terms of funding, teaching staff, and organization. More than 800 trainees from over 100 jurisdictions have participated.

OUR LOCATION

NO. 3(A) Longqing Street, Economic and Technological Development Area,

Beijing, CHINA

BRITACʘM Secretariat Office

Tel:0086-10-6198-6165, 0086-10-6198-6158

Email:secretariat@britacom.org

Web:www.britacom.org

Copyright @ 2020 BRITACʘM. ALL RIGHTS RESERVED