HOME / NEWS / BRITACOM Events

The Virtual Seminar on Service and Administration of VAT in Digital Times

Was Held on 15 October 2020

updated:2020-10-16

The virtual seminar on service and administration of value added tax (VAT) in digital times took place on 15 October 2020 with participants from the BRITACʘM Council Member Tax Administrations, Observers, and Advisory Board, and representatives from business in attendance. All participants and four presenters contributed to this informative and engaging event.

The COVID-19 pandemic has driven tax authorities to improve tax administration and services and reduce tax compliance costs through digitalization. The VAT is a popular revenue generator worldwide especially among developing countries with advantages including reducing administrative cost, strengthening taxpayers' self-compliance, and promoting stability and growth of revenue mobilization. Digital revolution has radically changed the traditional business model, and digital economy has dramatically impacted VAT administration. Many jurisdictions have acted rapidly and forcefully to resolve the VAT administration problems in digital economy through making sustained and remarkable progress on digital platform, e-filing, data-based tax administration, etc.

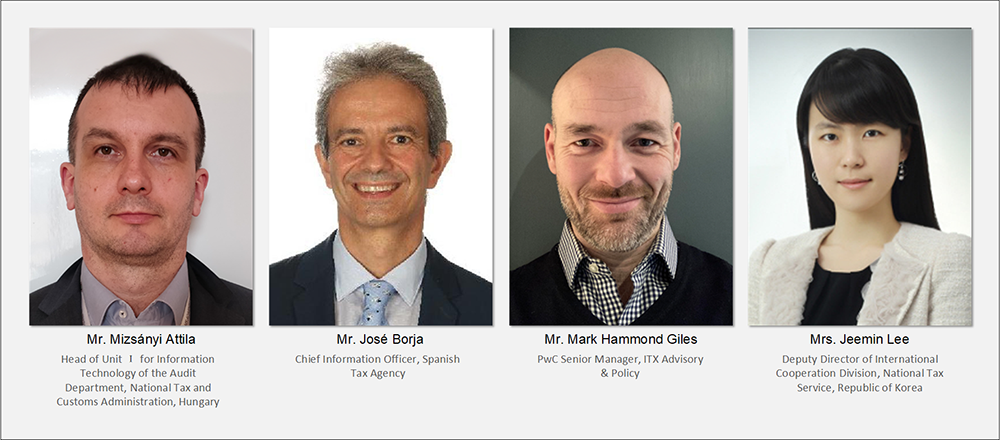

This virtual seminar mainly focuses on three subtopics: online cash registers and online invoicing in Hungary introduced by Mr. Mizsányi Attila from National Tax and Customs Administration of Hungary, SII system introduced by Mr. José Borja Tomé from Spanish Tax Agency, and Making Tax Digital introduced by Mr. Mark Hammond Giles from PwC. Besides, Mrs. Jeemin Lee from Korea National Tax Service also shared Korean experiences in e-tax invoice system. Participants from the Advisory Board, Ethiopia tax administration, ATAF, Singapore tax administration posed questions about electronic cash registers, B2C invoices, etc. towards the introduction of the four speakers.

While resulting in unprecedented economic slump, the pandemic has also brought new insights to tax authorities worldwide including those on development in VAT administration. The experiences sharing and interactive Q&A in this Seminar have shed light on VAT administration in digital times. More experiences in service and administration of VAT in digital times will be shared and discussions will be conducted in the follow-up meeting to be held on 22 October 2020.

Copyright @ 2020 BRITACOM. ALL RIGHTS RESERVED